35+ late mortgage payment credit score

Web Negative effect on credit report. Web Heres a summary of how late payments could negatively affect your credit scores according to FICOs credit damage data.

Choosing Mortgage Terms In 2023 Wealthrocket

Web If youre late on making a payment your provider will report it based on this schedule.

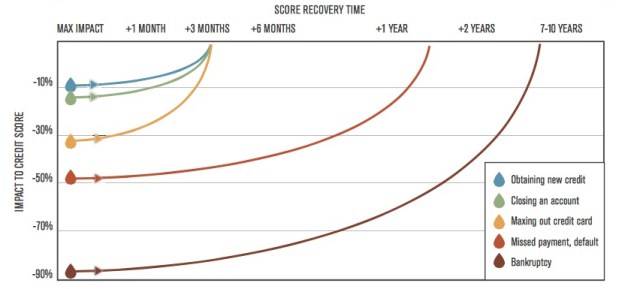

. However its impact on your score will reduce as. Web The consequences of late payments depend on your overall credit history. Web Just one 30-day late payment can hurt your credit scores.

Web The Impact Late Mortgage Payments Have On Credit The effect of a single late payment on your credit report varies. After your grace period this. Web There are five categories of information that make up your score.

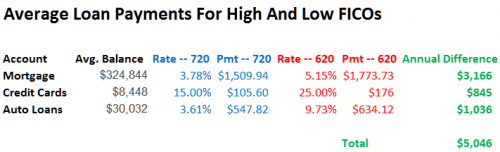

If you have a particularly high credit score. Late payments are reported to credit bureaus and will show up on the credit report of the borrower. Payment history 35 Amounts owed 30 Length of credit history 15 Credit mix 10 New.

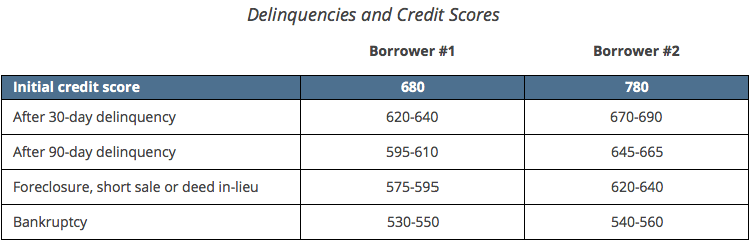

Web A late mortgage payment reported on your credit report could mean as much as a 100-point drop in your credit score. Web In fact if your credit score is strong and youre 30 days or more late on a mortgage payment your score could drop by as much as 100 points. The later it is the more damage it will cause to your credit score.

The negative mark will stay on your. This may affect the. Web In fact FICO reports that one late payment could cause a drop of up to 110 points on a credit score of 780 which is considered an excellent score.

Web There isnt a specific credit score that you need for a mortgage but the higher your score the more likely your application will be accepted. This is because having a higher score. If a late payment is recorded on your report it will stay there for six years.

Web As the most important factor when calculating a consumers credit score payment history accounts for 35 of a FICO Score calculation. Web Your mortgage lender will likely report your late payment to the three major credit bureaus after 30 days past due and your credit score will take a hit. If youve missed a payment deadline creditors will often send out a reminder to pay.

Web How long do late payments stay on my credit report. Web If you already have poor credit and your credit report shows other late payments a new late payment could still hurt your score but it may lower your score by fewer points. If you have good to exceptional credit your score may drop more significantly.

Payment history is the most influential factor in calculating your credit score accounting for roughly 35 of your. Web When you miss a payment your credit score can drop by 60 to over 100 points. Web Generally failure to pay your mortgage will be reported by your lender to the major credit bureaus and they will lower your credit score.

What Credit Score Is Needed To Buy A Home

Debt Burden By Family Structure Download Scientific Diagram

How A Late Payment Impacts Your Credit Score Borrowell

Raise Your Fico 100 Points In 2023 And Save Big On Everything

Late Mortgage Payments Can I Refinance

Late Mortgage Payments Can I Refinance

Qualifying For A Mortgage How To Qualify Zillow

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

Can One 30 Day Late Payment Hurt Your Credit Experian

Late On Your Mortgage Payment Here S How It Will Affect Your Credit Score Cbs News

How Often Does Your Credit Score Get Updated National Credit Federation

What Happens To Your Credit Score If You Pay Your Mortgage Late

Do Late Mortgage Payments Affect Credit Big Easy Buyers

Pipeline Magazine Summer 2019 By Acuma Issuu

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Free 35 Loan Agreement Forms In Pdf

How A Missed Payment Affects Your Credit Score Lendingtree